Short-term growth forecasts upgraded

New economic predictions produced by the Office for Budget Responsibility (OBR) suggest the UK economy is set to grow by more than previously expected over the course of the next two years.

Chancellor Jeremy Hunt unveiled the independent fiscal watchdog’s latest forecasts during his Spring Budget delivered to the House of Commons on 6 March. The updated figures predict the economy will expand by 0.8% this year, marginally higher than the OBR’s autumn forecast, while next year’s growth rate was revised up to 1.9% compared to a previous figure of 1.4%. The OBR said this strengthening near-term outlook was partly due to inflation receding more quickly than had previously been anticipated.

The week following the Chancellor’s Budget statement, the latest monthly gross domestic product (GDP) statistics were published by the Office for National Statistics (ONS) revealing that the UK economy returned to growth at the start of the year. The ONS figures showed the economy expanded by 0.2% in January following December’s 0.1% fall, with the rebound driven by strong growth in both the retail and construction sectors.

Data from the latest S&P Global/CIPS UK Purchasing Managers’ Index (PMI) also suggests this recovery has continued across the rest of the first quarter, with March’s preliminary composite headline figure once again coming in comfortably above the 50 threshold that denotes an expansion in private sector output.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “Further signs of the UK economy having pulled out of last year’s brief recession are provided by the provisional PMI data for March. The survey data are indicative of first quarter GDP rising 0.25% to thereby signal a reassuringly solid rebound from the technical recession seen in the second half of 2023. Business expectations for the year ahead also remain reassuringly lofty by recent standards.”

Lower interest rates “on the way”

Although last month did once again see the Bank of England (BoE) maintain interest rates at their current 16-year high, the Bank’s Governor noted that inflation is “moving in the right direction” for rate cuts.

At its latest meeting, which concluded on 20 March, the BoE’s Monetary Policy Committee (MPC) voted by an 8–1 majority to leave Bank Rate unchanged at 5.25%. The one dissenting voice preferred to see an immediate quarter-point reduction, which meant this was the first time since September 2021 none of the nine-member panel had voted for a rate hike.

The meeting ended the same day ONS released the latest inflation statistics. These revealed that February’s headline annual CPI rate dropped to 3.4% from 4.0% the previous month; this figure was slightly below analysts’ expectations and the lowest reported rate for almost two and a half years.

Speaking just after the interest rate decision, BoE Governor Andrew Bailey described the latest fall in inflation as “very encouraging.” While stressing the Bank needed to see inflation decline further, Mr Bailey did strike a relatively optimistic note on future rate reductions.

Asked whether investors were right to price in two or three cuts over the remainder of this year, Mr Bailey suggested it was “reasonable” for markets to take that view. The Governor added, “We’re not yet at the point where we can cut interest rates, but things are moving in the right direction. I think you know we can say – we are on the way.”

Prior to the MPC’s announcement, a Reuters poll found a majority of economists expect the BoE to begin cutting rates in the third quarter of this year, although a sizeable minority did predict the first cut would be delivered during the second quarter. The next MPC announcement is scheduled for 9 May.

Markets

At the end of March, most major markets closed in positive territory as investors contemplated new data from the US showing the economy grew faster than expected in Q4 2023.

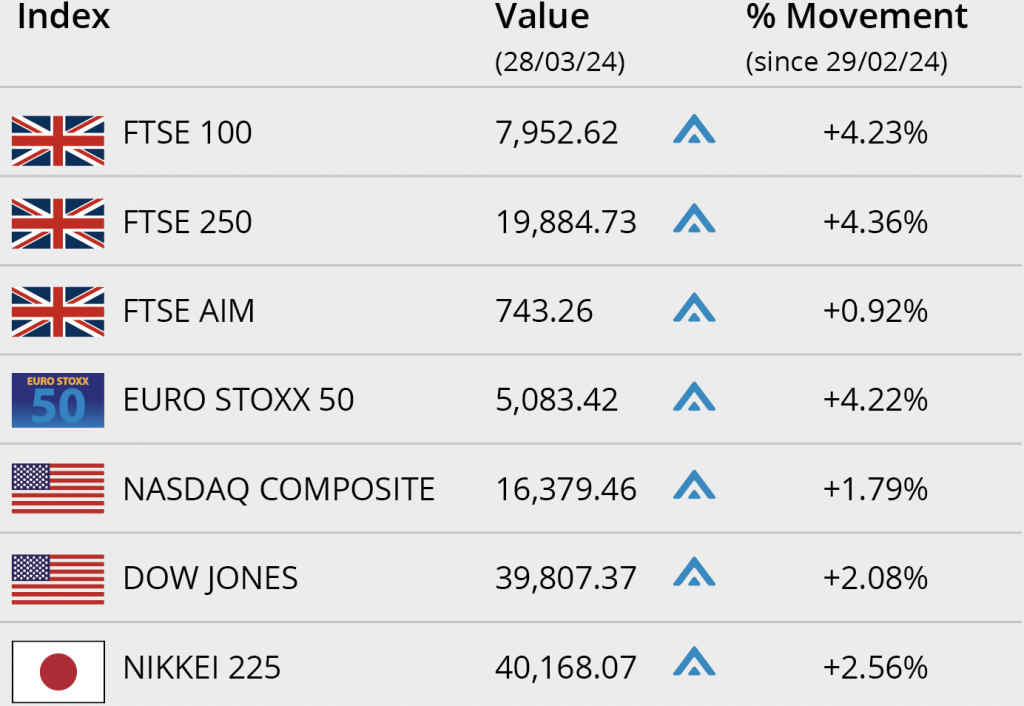

In the UK, the FTSE 100 index closed the month on 7,952.62, a gain of 4.23%, while the mid-cap focused FTSE 250 closed the month 4.36% higher on 19,884.73. The FTSE AIM closed on 743.26, a gain of 0.92% in the month.

On the continent, the Euro Stoxx 50 closed March on 5,083.42, 4.22% higher. In Japan, the Nikkei 225 continued its bull run, closing the month on 40,168.07 a gain of 2.56%. In the US, healthy economic data at month end helped support strength in the market. The Dow closed the month up 2.08% on 39,807.37, meanwhile the NASDAQ closed March up 1.79% on 16,379.46.

On the foreign exchanges, the euro closed the month at €1.17 against sterling. The US dollar closed at $1.26 against sterling and at $1.07 against the euro.

Brent crude ended the month trading at around $86 a barrel, a gain of 5.81%. The price has been supported by falling inventories and output cuts from OPEC+. Gold closed March trading around $2,207 a troy ounce, a monthly gain of 7.76%. Precious metal prices are trending higher despite US Treasury yields advancing.

(Data compiled by TOMD)

Consumer sentiment holding steady

Data released last month revealed a stabilisation in retail sales volumes while survey evidence suggests consumer confidence is also holding firm as households become more positive about their finances.

The latest official statistics showed that total retail sales volumes were flat in February, with ONS noting that sales were partly dampened by a reduction in footfall due to the month’s heavy rainfall. February’s figure was, however, stronger than most economists had predicted with the consensus pointing to a 0.3% monthly decline.

Last month’s CBI Distributive Trades Survey also suggests the retail sector’s prospects could be set to improve, with its headline measure of sales volumes in the year to March posting its first positive reading for 10 months. CBI Principal Economist Martin Sartorius said, “The stabilisation of retail sales in March should give some hope that the sector’s downturn is bottoming out” and he added “easing inflation should support retail spending going forward.”

Data from the latest GfK consumer confidence index also suggests consumer sentiment is holding steady, with its headline figure remaining unchanged in March. In addition, the survey revealed that households turned positive about the outlook for their personal finances for the first time in over two years.

Economic inactivity figures rise again

The latest set of employment statistics have revealed another increase in the UK’s economic inactivity rate with over a fifth of all working-age adults now not in work or looking for a job.

Figures published last month by ONS showed that the economic inactivity rate for those aged 16 to 64 years was 21.8% in the November to January period; this represents a slight increase from the previous quarter and also puts the figure above the level recorded a year earlier. This means that, in total, there are currently around 9.2 million people of working-age that are neither in employment nor looking for work.

The growing problem of long-term illness has clearly been a key factor driving this rise, with a report recently published by the Resolution Foundation showing the country is going through its longest sustained increase in the number of working-age people too sick to work since the 1990s.

According to the Resolution Foundation’s analysis, economic inactivity due to long-term sickness has been on an upward trend since July 2019 or the past 54 months. The think tank’s report also revealed that the youngest and oldest age brackets had the highest proportion of those out-of-work due to ongoing illness.

All details are correct at the time of writing (28 March 2024). Written and supplied by The Outsourced Marketing Department.