BoE starts to cut rates

In early August, the Bank of England (BoE) sanctioned the first reduction in interest rates since March 2020 and economists expect a second cut to be announced before the end of this year.

The closely-run decision was announced on 1 August following the latest meeting of the Bank’s Monetary Policy Committee (MPC). At the meeting, the nine-member panel voted by a slim 5-4 majority to reduce rates by 0.25 percentage points, taking Bank Rate down to 5%. The four dissenting voices each voted to leave rates unchanged.

Commenting after announcing the cut, BoE Governor Andrew Bailey described the decision as “an important moment in time” although he did stress people should not expect rates to fall sharply over the coming months. Mr Bailey noted that lower inflation had paved the way for the reduction but added that policymakers needed to be sure inflation remains low and be “careful” not to cut rates “too quickly or by too much.”

The latest set of consumer price statistics, which were published by the Office for National Statistics (ONS) two weeks after the MPC announcement, did actually reveal a rise in inflation for the first time this year. The annual headline rate rose to 2.2% in July following two consecutive months at the BoE’s 2% target level – the figure was, however, lower than the 2.3% consensus forecast predicted in a Reuters poll of economists.

While the BoE has stressed that further rate cuts will not be rushed, July’s lower than anticipated inflation figure does appear to have increased the chances of another reduction before the year-end. Although most economists in a recent Reuters survey did say they expect rates to remain on hold this month, a majority predicted the BoE will sanction one more cut this year, with November seen as the most likely month for that move.

UK economy grows strongly

Second quarter gross domestic product (GDP) figures released last month by ONS showed the UK economy has continued its strong recovery from last year’s brief recession, while more recent survey data points to relatively solid third quarter growth too.

The latest GDP statistics showed UK economic output rose by 0.6% between April and June; this figure was in line with economists’ expectations and represents only a marginal dip from the robust rate recorded during the first three months of the year. ONS said the second-quarter expansion was driven by strong service sector growth, which offset small quarterly contractions in both the manufacturing and construction sectors.

While economists have warned that the current pace of growth is unlikely to be maintained across the second half of 2024, the stronger-than-anticipated GDP figures so far this year have prompted economic soothsayers to upwardly revise their full-year forecasts. Early last month, for instance, the BoE upgraded its projections, which now predict the UK economy will expand by 1.25% across the whole of 2024, up from a previous forecast of 0.5%.

Recently-released survey evidence, though, does point to a third-quarter slowdown, although the data does still suggest the economy continues to expand at a reasonable pace. The flash headline growth indicator from the S&P Global/CIPS UK Purchasing Managers’ Index (PMI), for instance, rose from 52.8 in July to 53.4 in August; both figures comfortably above the 50 threshold denoting growth in private sector output.

Commenting on the survey, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson, noted that the manufacturing and service sectors both reported solid growth in August. He added, “Although GDP growth looks set to weaken in the third quarter compared to the impressive gains seen in the first half of the year, the PMI is indicative of the economy expanding at a reasonably solid quarterly rate of around 0.3%.”

Markets

As August drew to a close, investor attention shifted toward a potential interest rate cut in the US, following remarks from Federal Reserve Chairman Jerome Powell during his keynote speech at the annual Jackson Hole economic symposium.

Powell said, “The time has come for policy to adjust… The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Investors look ahead to the Fed’s next meeting on 17-18 September.

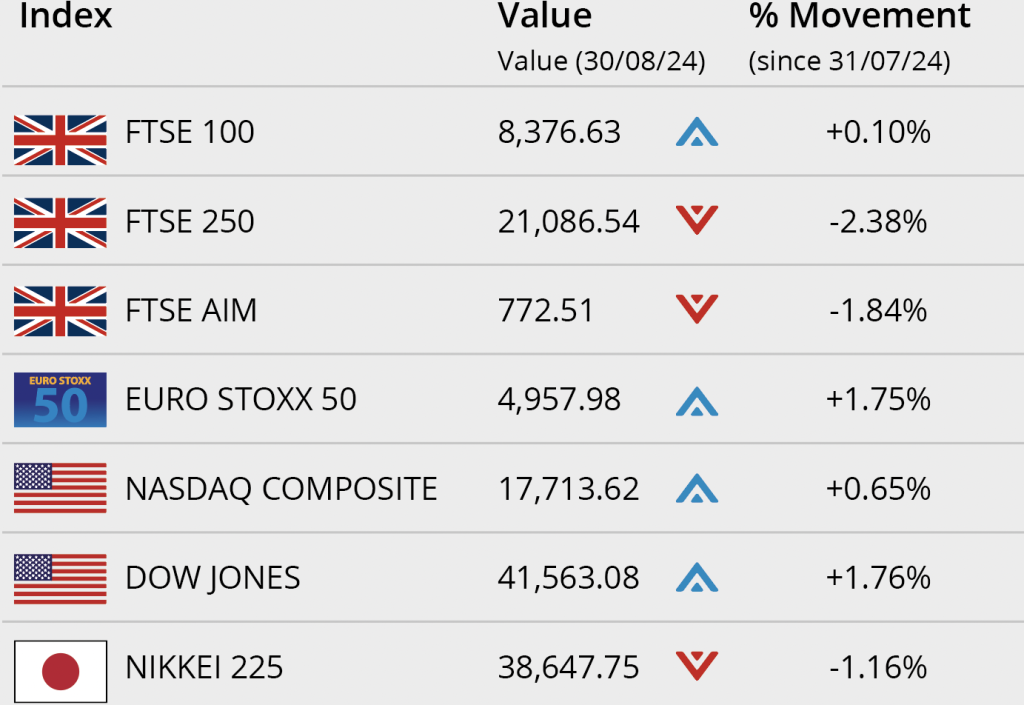

On 30 August, the UK’s FTSE 100 ended flat, but registered its second consecutive monthly gain. Real estate shares were robust at month end as interest rate-cut hopes held firm. The index closed the month on 8,376.63, a small monthly gain of 0.10%, while the FTSE 250 closed the month 2.38% lower on 21,086.54. The FTSE AIM closed on 772.51, a loss of 1.84% in the month. The Euro Stoxx 50 closed August on 4,957.98, up 1.75%. In Japan, the Nikkei 225 closed the month on 38,647.75, a monthly loss of 1.16%.

In the US, the Dow Jones registered some solid gains, closing the month up 1.76% on 41,563.08, ending on a high. Meanwhile the NASDAQ closed August up 0.65% on 17,713.62.

On the foreign exchanges, the euro closed the month at €1.18 against sterling. The US dollar closed at $1.31 against sterling and at $1.10 against the euro.

Gold closed August trading at $2,513.35 a troy ounce, a monthly gain of 3.59%. The dollar has strengthened against gold following recent all-time highs for the safe haven commodity. Brent crude closed the month trading at $76.83 a barrel, a loss over the month of 5.04%. Crude lost ground during August as concerns about demand and the prospect of increased supply from OPEC+ weighed on prices.

(Data compiled by TOMD)

Nominal wage growth continues to slow

Official earnings statistics released last month showed nominal pay is now rising at its slowest pace in almost two years with survey evidence suggesting this slowdown looks set to continue.

The latest ONS figures revealed that average weekly earnings excluding bonuses rose at an annual rate of 5.4% in the three months to the end of June. This was down from 5.8% in the previous three-month period and the lowest recorded figure since August 2022. After adjusting for CPI inflation, however, regular pay is still rising at an annual rate of 3.2%, the joint-largest rise in real earnings for around three years.

Data from a Recruitment and Employment Confederation survey released early last month found that nominal pay growth increased even more slowly in July than it had in June. Additionally, the survey reported that the pace of pay increases for temporary staff is currently the weakest in over three years.

Research from the Chartered Institute of Personnel and Development also suggests wage growth is likely to fall back further over the coming year. According to the survey, employers expect to raise pay levels by an average of 3% over the next 12 months, which would represent the smallest pay rises in two years.

Euros and discounting boosts retail sales

Although survey data released last month continues to highlight a tough retail environment, the latest official figures did reveal a rebound in sales volumes during July while hopes of rising real incomes triggering a boost to spending remain.

Data recently published by ONS showed total retail sales volumes rose by 0.5% in July following June’s 0.9% decline. ONS said sales in department stores and sports equipment stores grew strongly in July with retailers saying summer discounting and sporting events, such as Euro 2024, provided a boost to sales.

Encouragingly for the retail sector, the latest GfK consumer confidence index continues to report relatively strong levels of consumer sentiment. Indeed, August’s headline figure held steady at an almost three-year high, as households took an increasingly positive view of their personal finances and showed greater enthusiasm for major purchases.

Recently-released survey data, though, did highlight the relatively difficult trading conditions retailers continue to face, with the CBI Distributive Trades Survey reporting sales as ‘poor’ for the time of year in August, with sales volumes expected to disappoint in September too. The CBI did note, however, that retailers should ‘gradually begin to see some tailwinds from consumers’ rising real incomes.’

All details are correct at the time of writing (30 August 2024). Written and supplied by The Outsourced Marketing Department.