Interest rates set to fall more gradually

Last month, the Bank of England (BoE) cut interest rates for only the second time since 2020 but also warned future reductions were likely to be more gradual due to the prospect of inflation creeping higher next year.

Following its latest meeting, which concluded on 6 November, the BoE’s nine-member Monetary Policy Committee (MPC) voted by an 8-1 majority to reduce rates by 0.25 percentage points. This took Bank Rate down to 4.75%.

Commenting after announcing the news, BoE Governor Andrew Bailey suggested rates were likely to “continue to fall gradually from here” although he did caution that they would not be reduced “too quickly or by too much.” Mr Bailey was also at pains to emphasise the word “gradual” and added that the reason for such an approach was that “there are a lot of risks out there in the world at large and also domestically.”

Alongside the rate announcement, the Governor unveiled the BoE’s latest economic forecast which takes account of the Chancellor’s Budget measures. The updated projections suggest the policies announced in the Budget are likely to boost the headline rate of inflation by almost half a percentage point at its peak in just over two years’ time and result in it taking a year longer for inflation to return to the Bank’s 2% target level.

The latest inflation data, which was published by the Office for National Statistics (ONS) two weeks after the MPC announcement, revealed that the annual headline rate jumped from 1.7% in September to 2.3% in October. While this sharp increase was largely driven by October’s energy price hike, the figure did come in slightly ahead of analysts’ expectations. This overshoot, combined with the Governor’s comments, has undoubtedly increased the prospect of interest rates remaining unchanged following the MPC’s final meeting of the year on 19 December.

UK economy losing momentum

Gross domestic product (GDP) statistics released last month by ONS showed the economy barely grew between July and September, while more recent survey evidence points to a further loss of economic momentum.

The latest GDP figures revealed that UK economic output rose by just 0.1% across the whole of the third quarter. This figure was weaker than economists had expected and represents a sharp slowdown from the 0.5% growth rate recorded during the second quarter of the year.

A monthly breakdown of the data also showed the economy actually contracted by 0.1% during September alone, with ONS reporting a significant drop in manufacturing output while the services sector flatlined. A number of economists blamed September’s weakness on Budget uncertainty which was felt to have impacted the behaviour of both firms and households.

Data from a recently released economic survey also suggests business optimism continued to slide in the weeks following October’s Budget. Indeed, the flash headline growth indicator from the S&P Global/CIPS UK Purchasing Managers’ Index (PMI) fell to 49.9 in November from 51.8 in October, the first time in 13 months the figure had dipped below the 50 threshold, denoting a contraction in private sector output.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “The first survey on the health of the economy after the Budget makes for gloomy reading. Although only marginal, the downturn in output represents a marked contrast to the robust growth rates seen back in the summer and are accompanied by deepening concern about prospects for the year ahead.”

Last month also saw the BoE publish revised economic growth projections. While the Bank did trim this year’s forecast from 1.25% to 1.0%, it is now predicting a stronger 2025, with next year’s projected growth figure upped to 1.5% from a previous forecast of 1.0%.

Markets

At the end of November, investors closely monitored the threat of possible US tariffs and the ongoing political turmoil in France. On the last trading day of the month, European markets closed slightly higher as inflation estimates met expectations, while the FTSE 100 was flat. Meanwhile, across the Atlantic, US stocks tempered from record highs reached earlier in the week.

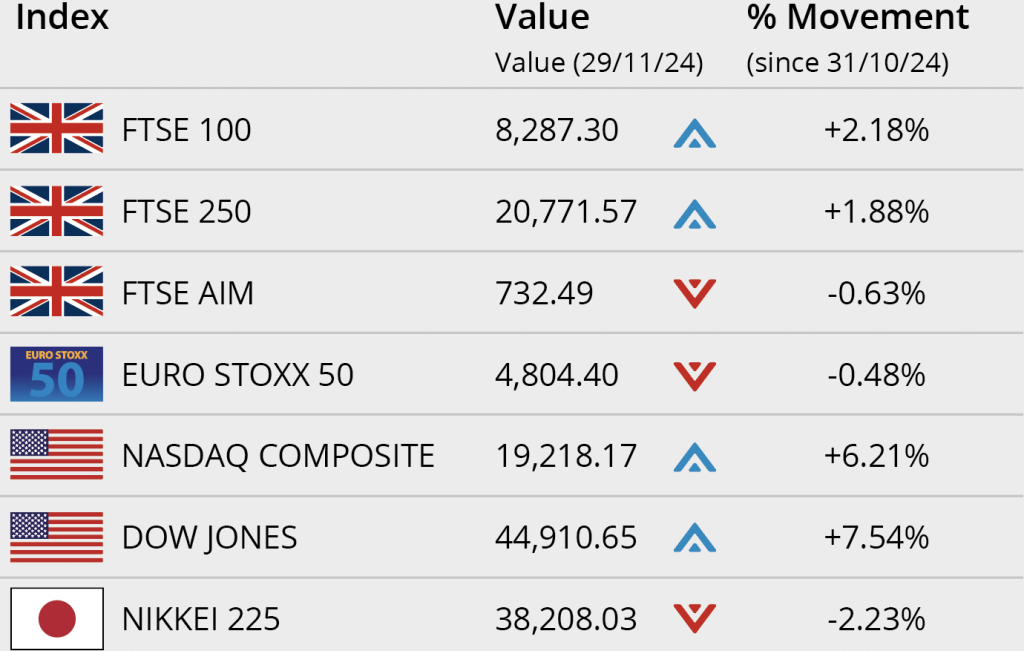

In the UK, the FTSE 100 index closed the month on 8,287.30, a gain of 2.18%, while the FTSE 250 closed November 1.88% higher on 20,771.57. The FTSE AIM closed on 732.49, a loss of 0.63% in the month. The Euro Stoxx 50 closed November on 4,804.40, down 0.48%. In Japan, the Nikkei 225 closed the month on 38,208.03, a monthly loss of 2.23%.

In the US, President-elect Donald Trump has outlined plans to place levies on imports from Canada, Mexico and China, with concerns that his plans could extend to other regions. The Dow Jones closed November up 7.54% on 44,910.65, while the tech-orientated NASDAQ closed the month up 6.21% on 19,218.17.

On the foreign exchanges, the euro closed the month at €1.20 against sterling. The US dollar closed at $1.26 against sterling and at $1.05 against the euro.

Brent crude closed November trading at around $68 a barrel, a loss over the month of 5.40%. Oil prices fluctuated at month end as speculation over OPEC+’s production plans heightened in advance of their December meeting. Gold closed the month trading at around $2,683 a troy ounce, a monthly loss of 1.84%.

(Data compiled by TOMD)

Unemployment rate rises

Official figures published last month revealed a rise in the rate of unemployment, although ONS has warned that the data should be treated with some caution due to smaller survey sample sizes increasing data volatility.

The latest ONS labour market release showed the unemployment rate stood at 4.3% between July to September 2024; this compares to 4.0% for the previous three-month period. The data also revealed that the number of payrolled employees decreased by 9,000 in the three months to September, with early estimates suggesting the figure dropped by a further 5,000 in October.

Job vacancies also fell again, with 35,000 fewer reported in the August–October period compared to the previous three months. Overall, the statistics agency said that the latest batch of data points to a ‘continued easing of the labour market.’

ONS is currently in the process of overhauling the statistical methodology used to calculate its labour market figures – research released last month by the Resolution Foundation highlighted the current problems surrounding data reliability. According to the think tank’s analysis of tax office, self-employment and new population data, the official statistics may currently be failing to count as many as a million people who are believed to be in work.

Retail sales fall by more than expected

The latest official retail sales figures showed sales volumes declined ahead of October’s Budget, while more recent survey data points to ‘disappointing’ sales in November too.

Figures released last month by ONS revealed that retail sales volumes fell by 0.7% in October, following a period of growth across the previous three months. While analysts had predicted a sales dip, October’s decline was larger than expected. ONS said the fall was driven by a ‘notably poor month for clothing stores’ but also noted that retailers across the board reported consumers holding back spending ahead of the Budget.

Data from GfK’s latest consumer confidence index did offer the retail sector some cheer, though, with the long-running survey reporting less pessimism post-Budget. November’s headline figure rose to its highest level since August, with growth recorded across all five components of the survey, suggesting consumers may have more appetite for spending in the run-up to Christmas.

November’s CBI Distributive Trades Survey, however, found retailers expect trading conditions to remain tough. While the survey did acknowledge ‘some improvement’ in the retail environment since the middle of the year, it also reported ‘disappointing sales’ in November with volumes expected to remain below seasonal norms in December too.

Written and supplied by The Outsourced Marketing Department. All details are correct at the time of writing (2 December 2024)